Single premium credit life insurance provides insurance coverage for loan takers who are at the risk of loan default due to death or total permanent disability.

What you get!

- Loan Coverage

- Financial security for you and your family members

- Tax Deductable

Key Features

- Policy Term: 1 years - 15 years

- Sum Insured: 1,000,000 - 300,000,000 Kyats

- Insurable Age: 18 – 60 years old

- Beneficiary: Bank or Microfinance or Lending Institutions

Benefits

- Death

- Total Permanent Disability

More Information

For more enquiry, please inquire on Contact Us or our Call Center at 01-2317770.

FAQs

What benefits can I get from Credit Life Insurance?

Upon loan taker’s Death or Total Permanent Disability before full repayment of the loan, his/her dependents are protected from taking up liabilities that they were not a party to and/or privy to and from the loss of the mortgaged property.

Who is the beneficiary in Single Premium Credit life insurance?

Lenders (Bank or Microfinance or Financial Institution)

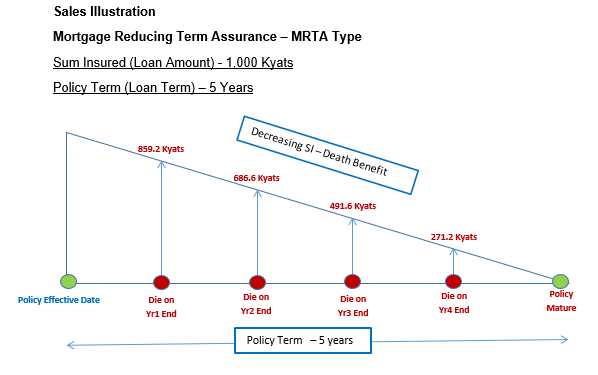

What will be the Sum Insured and Coverage Period?

The Sum Insured will be Loan amount and Coverage will be Loan term.

Describe the benefits of single premium credit life insurance?

- Death

- Total Permanent Disability

- Surrender Value (upon full loan repayment by the borrow before the end of loan term)

- Tax Deductible

Is medical examination required?

Yes.