Corporate credit cards are credit cards issued to employees of established companies that let them charge their authorized business expenses—such as hotel stays and plane tickets —without having to use their own card or cash. These cards, which are also known as commercial credit cards, can make it easier for employees (and employers) to manage expenses, and many offer perks.

Transportation Benefit

Priceless Benefits for Travel, Accommodation, Dining & Entertainment

links :

- Accommodation: https://specials.priceless.com/en-ap/programs/one_night_free_with_master...

- Travel: https://specials.priceless.com/en-ap/categories/Travel?Cid=201811010001&...

- Dining: https://specials.priceless.com/en-ap/categories/Culinary?Cid=20181101000...

- Entertainment Offers: https://specials.priceless.com/en-ap/categories/Entertainment?Cid=201811...

- Arts & Culture: https://specials.priceless.com/en-ap/categories/Arts_and_Culture?Cid=201...

CB Bank Hotel Program

CB Bank Dining Program

Priceless Specials –Shopping Offers (link : https://specials.priceless.com/en-ap/categories/Shopping?Cid=20181101000...)

Super Office Supplies Savings

CB Bank IPP Store – Instalment Payment Plan

CB Reward Points

- Card Issuing Fee

Will waive for frequent flyers and top tier/member.

Give discount to the other tiers/members.

- Platinum – MMK 50,000

- Card Annual Fee

First year waived.

Second year waived if spending is minimum MMK 1,000,000 and above.

- Platinum – MMK 120,000

- Purchase – 20% p.a

- Credit Usage – Free of Charge

- Cash Advance – 18% p.a

- Minimum repayment : 10% of outstanding amount

- Full repayment : Full outstanding amount

- CB Pay or CB Bank Mobile Banking payment channel

- CB Bank Internet Banking payment channel

- Cash and Cheque payment over the counter

- Direct Debit from the CB Bank account

Smart Data Reporting – ability to access customized reports for analysis and reconciliation

Smart Data Expense Management – streamline business expense claim process

2% cash back at Gas Stations on up to 5,000,000MMK purchases each quarter (Maximum 500,000 MMK per card)

Card Type - Platinum

Corporate credit cards are credit cards issued to employees of established companies that let them charge their authorized business expenses—such as hotel stays and plane tickets —without having to use their own card or cash. These cards, which are also known as commercial credit cards, can make it easier for employees (and employers) to manage expenses, and offer many perks.

CB Bank Corporate Credit card is available to new and existing CB Bank customers whose companies registered in Myanmar meet our lending criteria. The owner or an authorized officer who can borrow on behalf of the business can apply for the corporate credit cards. Applicants should be Myanmar residents or resident aliens with a Myanmar address.

Companies use corporate credit cards so that employees can charge authorized business expenses, such as hotel stays and flights, without relying on their own credit cards or cash. A corporate card usually carries a company's name as well as the name of the employee designated as the cardholder.

It is easy to apply for a CB Bank Corporate Credit card. You can apply via:

- Corporate Banking Relationship Manager or

- Branches

Application process can be completed within 14-21 business days. You will be contacted via phone if there are questions related to your application or documentation required. As a regulatory requirement, a credit decision will be mailed to you within 30 days of application submission.

Only eligible purchases made on the account will earn points in your chosen rewards program. You do not earn points on balance transfers and cash advances or in other circumstances as set out in the program terms and conditions. Any refund or chargeback transaction processed on a retail purchase will reverse the points earned for that transaction.

You will lose your CB Rewards when your CB Bank Corporate Credit Card closes.

One of the key advantages of a corporate credit card is the ability to manage expenses more easily. A company can set a limit on how much a cardholder can spend overall or per transaction. It can even control where a card can be used, limiting purchases to certain types of merchants or certain countries.

The CB Mastercard Corporate Credit Card allows up to 45 days interest-free on purchases when you pay the closing balance (including any balance transfer amount) by the statement due date each month.

The CB Mastercard Corporate Credit Card is ideal for:

- A credit card solely dedicated to corporate purchases

- Covering short term cash flow

- Separating business and personal expenses

- Maintaining visibility of business spending with detailed monthly statements

- Reducing administration time by avoiding checkbooks.

- Able to enjoy offers and promotions by CB Bank and Mastercard.

A corporate credit card with personal liability, the company owner is personally liable for all transactions on the credit card account.

For a corporate credit card with joint and several liabilities, the principal is jointly and severally liable for all transactions on the credit card account. It is ideal for joint enterprises and partnerships where the business owners or directors jointly take responsibility for the balance owing on the credit card.

Yes, your corporate name will appear above the individual cardholder name on each card.

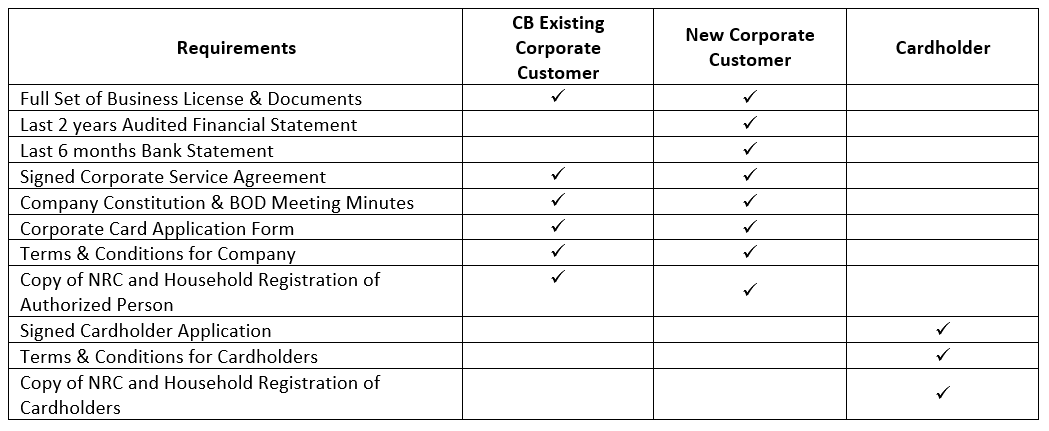

If you are a new customer to CB Bank:

- Full set of Business License & Documents

- Company Constitution & BOD Meeting Minutes

- Audited Financial Statement for the past 2 years

- Company/ Personal Bank Statement (Any Bank)

- Authorized person NRC (Front & Back)

- Authorized person household list

- Applicant’s NRC (Front & Back)

- Applicant’s Household list

- For Expatriates – Valid Work Permit (more than six months)

- Applicant Specimen Signature Record Form

If you are an existing CB Bank customer without corporate Loan:

- Full set of Business License & Documents

- Company Constitution & BOD Meeting Minutes

- Last 2 years Audited Financial Statement

- Authorized person NRC (Front & Back)

- Authorized person household list

- Applicant’s NRC (Front & Back)

- Applicant’s Household list

- For Expatriates – Valid Work Permit (more than six months)

- Applicant Specimen Signature Record Form

If you are an existing CB Bank customer with a corporate Loan:

- BOD Meeting Minutes

- Authorized person NRC (Front & Back)

- Authorized person household list

- Applicant’s NRC (Front & Back)

- Applicant’s Household list

- For Expatriates – Valid Work Permit (more than six months)

- Applicant Specimen Signature Record Form

Please note additional financial information or other documents may be requested prior to the completion of your application review.

There is no limit to the number of cards. New applicants can request additional cardholders when applying. Existing clients can request additional cardholders by providing necessary documents to the bank.

You can use anywhere Mastercard card is accepted.

Yes. The purchase with the Credit Card is interest free. The interest free period is between minimum 15 days and maximum 45 days for POS and ecommerce transactions.

20% per annum

18% per annum

Yes.

Yes.

Corporate RM will contact you when the card is ready for collection.

You must sign at the back of the card on the white strip.

You may start using the card after activation.

It is advised that customers keep their Credit Card receipts for cross-checking with bank statement. The customers must immediately inform the bank if there is any discrepancy between receipts and statement.

The repayment must be made before the overdue date stated in the statement.

- Minimum repayment : 10% of outstanding amount

- Full repayment : Full outstanding amount

- CB Pay or CB Bank Mobile Banking payment channel

- CB Bank Internet Banking payment channel

- Cash and Cheque payment over the counter

- Direct Debit from the CB Bank account

- Do not transfer your card to others

- Do not write PIN on your card

- Do not disclose data on your card to others

*It is the sole responsibility of the user to safe-keep the data that can be used in fraud as well as the consequences of such misdemeanor.

Contact immediately to the CB Bank’s call center (+9512317770).

- Loss of card or stolen

- PIN disclosure

- Damage of card

Immediately inform the bank. There will be a prevailing rate of MMK 10,000 as service fees. The bank will transfer the remaining balance to the new card.

The bank may waive service fees of MMaK 10,000 or partially if the chip that contains safety data has an error or with local police testimony for the loss of card.