Use your immovable property such as lands and buildings, to finance your business needs.

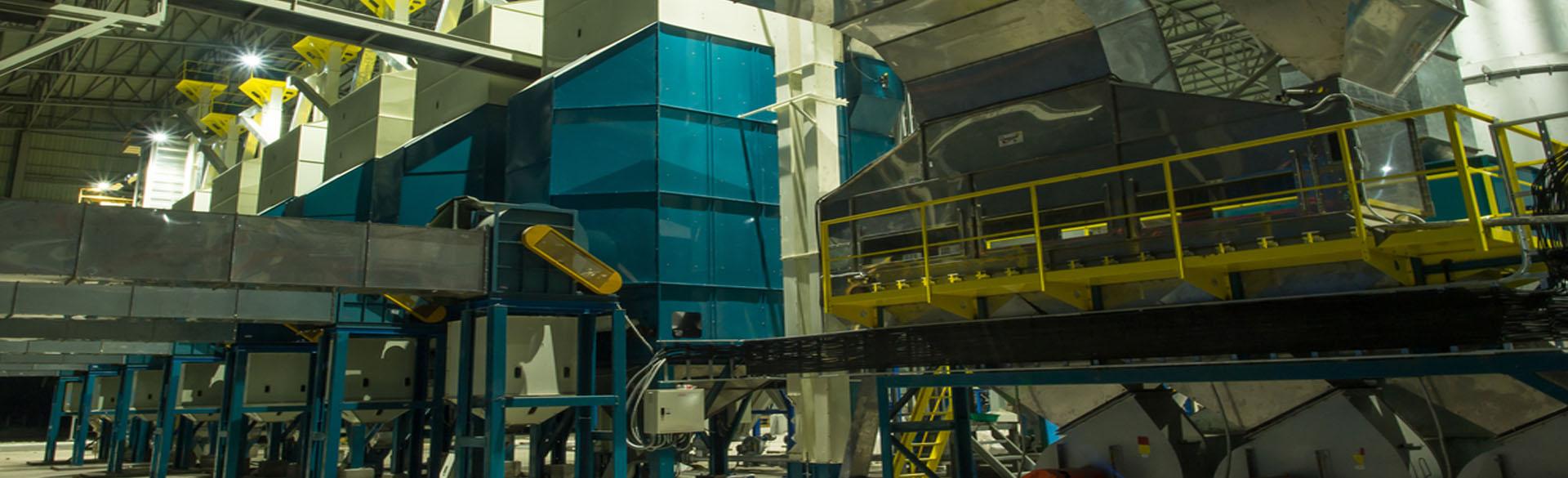

SME Term loan is a type of loan suitable for businesses that are aiming to boost their working capital requirements or financing other capital investments such as building factories/warehouses, upgrading or buying machineries, expanding business operations.

- Suitable for businesses that are at least 2 years old.

- Repayment Period of up to 3 years

- Interest rate – 13% p.a.

Eligibility:

- Must be a local company and registered in Myanmar

- Required to possess immovable properties to use as collateral

A local SME that is registered in Myanmar at least 2 years in lifetime can apply SME Term Loan.

No, there is no limitation on its allocation but loan must be aiming to boost their working capital requirements or financing other capital investments such as building factories/warehouses, upgrading or buying machineries, expanding business operations.

Yes. In order to apply for SME Term Loan, you need immovable property such as lands and buildings.

SME Term Loan’s repayment is from 1 year to 3 years and its interest rate is 10%-14.5% p.a.

There will be a monthly interest charge whilst principal payment could be in every 3 months or 6 months or yearly depending on individual loan amount, tenor and business plan.

Maximum SME Term Loan is MMK 650 million and the amount of loan is determined depending on individual’s market condition, business’s mission, financial records, management experience and its skillfulness, technology usage, collateral and business plan.

You must submit details business plan such as which machinery or building or equipment that you are going to invest with the applied loan.

Quotation must be requested from your suppliers where you purchase the equipment or raw materials. Quotation must include the type of equipment or raw materials you are going to buy, price, model number, photo and shop address. If you have a previously purchased voucher, you will need to attach it.

If the SME business owner agrees to the loan amount and term, the bank must proceed with the fire insurance. The fire insurance company will be notified by the relevant insurance company through the bank. Fire insurance premiums must be paid before the SME loan is issued by SME loan applicants.

Finance and insurance services, gambling, such as casinos, firearms and ammunition, activities that affect the environment and society, unlawful activities such as drugs and other drug-related businesses are restricted from applying a loan.