Short term endowment life insurance aims to provide financial assistance in case of tragedies as well as to save predetermined amount of money after a certain period.

What you get!

- Financial security

- Good savings habit

- Tax Deductable

Key Features

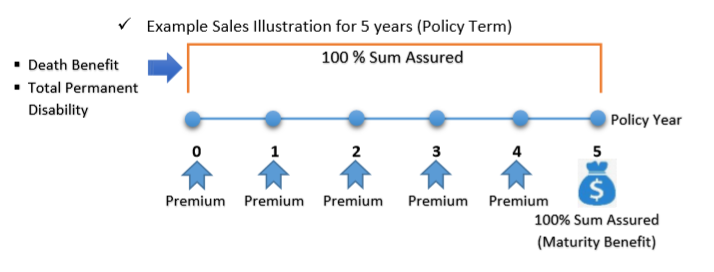

- Policy Term: 5 years, 7 years, 10 years (As you choose)

- Premium Term: 5 years, 7 years, 10 years

- Sum Insured: 1,000,000 Kyats - 50,000,000 Kyats (to be paid out upon maturity or when the unfortunate event occurs)

- Insurable Age: 10 – 60 years old

Beneifts

FAQs

What are the benefits of Short Term Endowment life insurance?

- Tax Deductible

- Maturity Benefit

- Death

- Total Permanent Disability

- Surrender value (if a policy holder decides to exit the policy before maturity)

- Paid-up policy (the policy holder decides not to make payments anymore but will get the Paid- Up Value [less than paid premium] back when the policy is matured)

What are the available policy terms in this insurance?

The policy terms can be 5 years/7 years/10 years.

Is medical check-up required?

Yes, medical check-up is required based on the age of the applicant and sum insured amount.

What are the exclusions for the total permanent disability benefit of the Short Term Endowment Life insurance?

The exclusion lists are as below:

- Intentional self-harm

- Suicide attempt – within 1st year of the policy

- Abuse of narcotic drugs

- Take Illegal medicine/ tablets

- Death or Total Permanent Disability due to an involvement in a commit crime and

- Undisclosed pre-existing illness or disease within 1st year of the policy

*For above cases, policyholder will only get back the total premium paid.