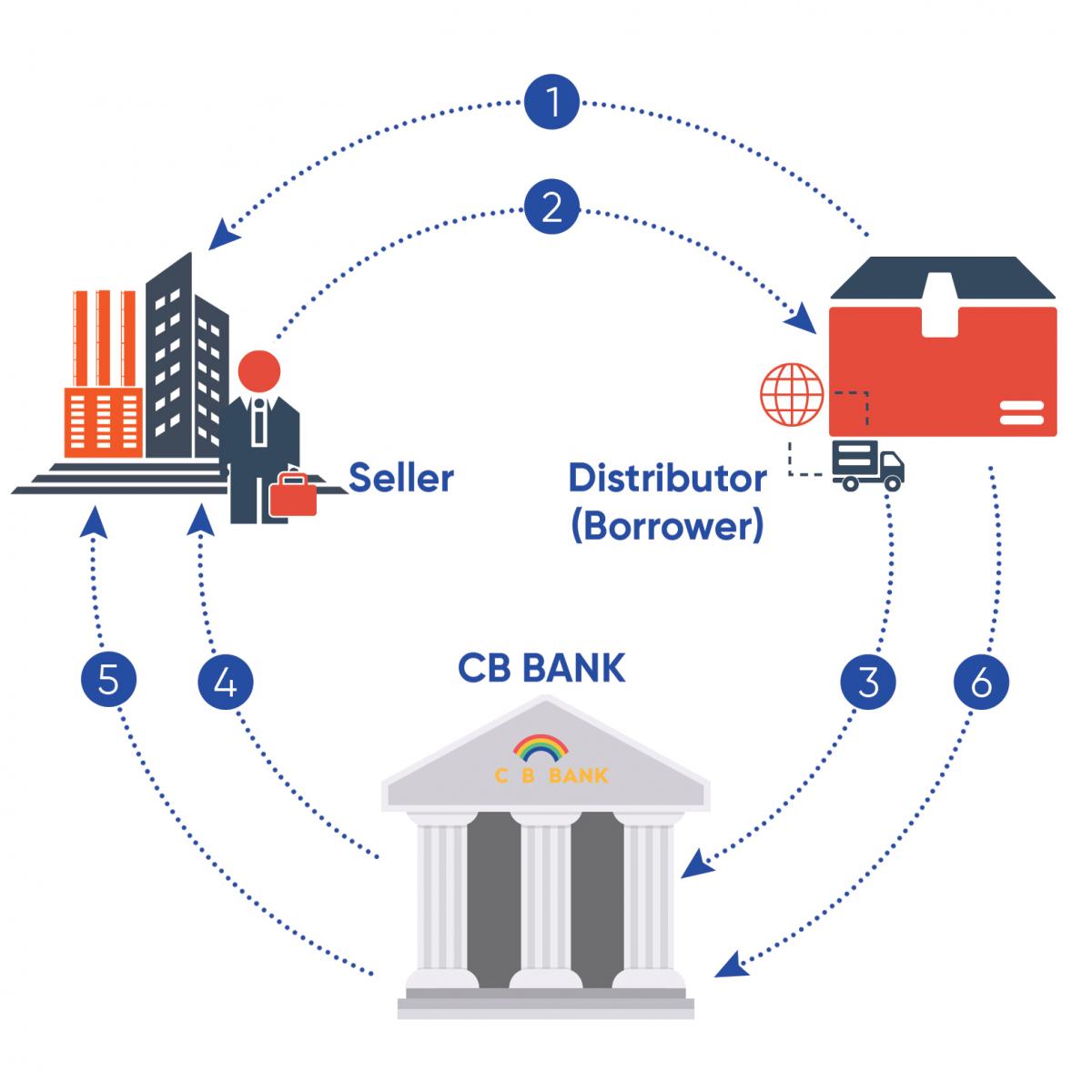

Distributor financing is a type of short-term financing where the bank helps to solve cash flow issues by providing the payable solution and extending the days payable outstanding (credit term) of the distributor.

| 1. Distributer issues purchase order | 2. Seller sells goods and sends invoices |

| 3. Distributer sends copy of invoices and request for financing | 4. Bank verifies and approves the invoice with seller |

| 5. Bank funds payment on invoice due date | 6. Borrower makes repayment on financing due date |