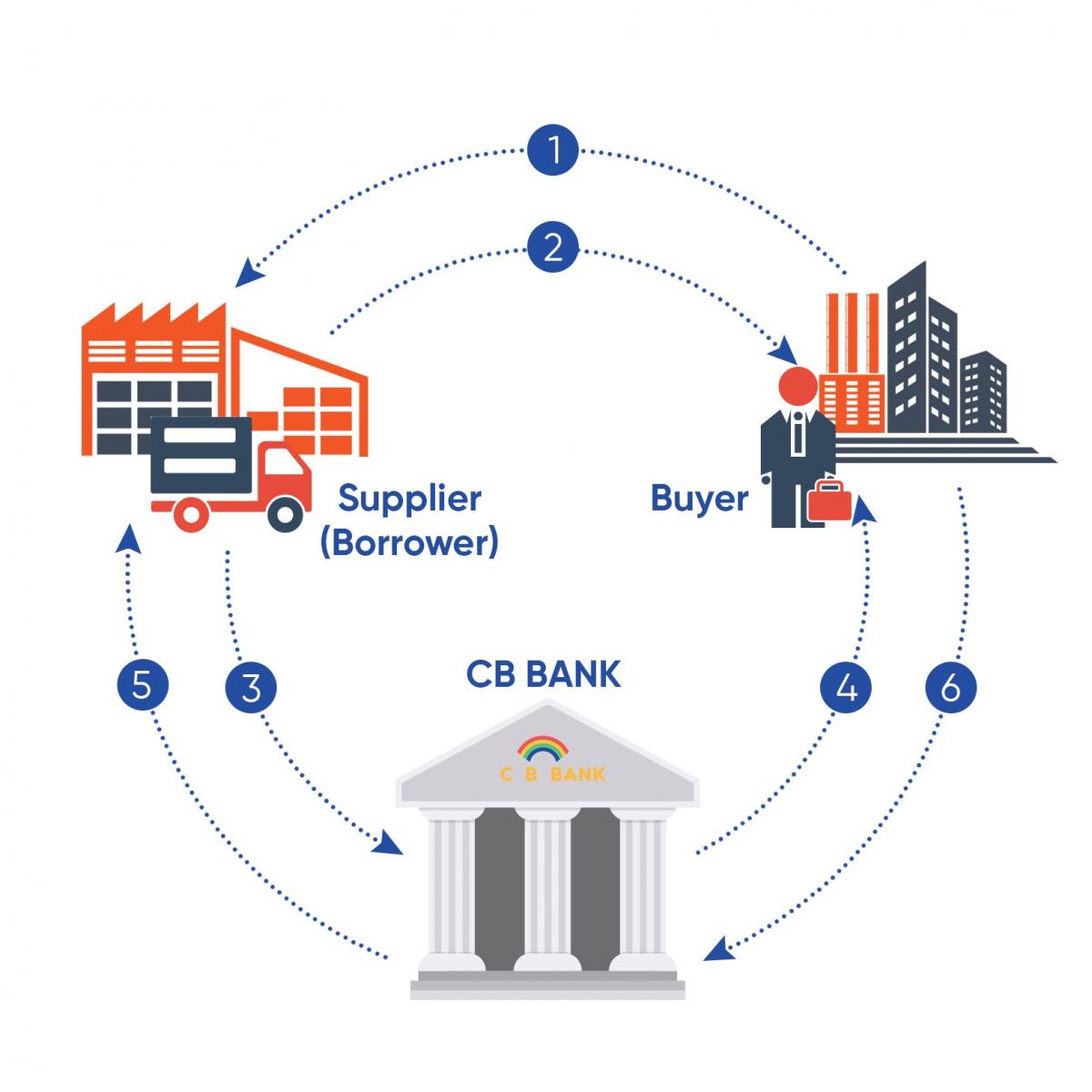

Invoice financing is a type of short-term financing where the suppliers can finance receivables using their confirmed invoices. CB Bank provides financing for the open account sales of the supplier (“Borrower”) by advancing funds prior to receipt of proceeds from the buyer on invoice due date.

| 1. Buyer issues purchase order | 4. Bank verifies and approves the invoice with buyer |

| 2. Supplier deliver goods and issues invoice | 5. Bank funds early payment to supplier |

| 3. Supplier requests financing for early payment | 6. Buyer makes payment on invoice due date |