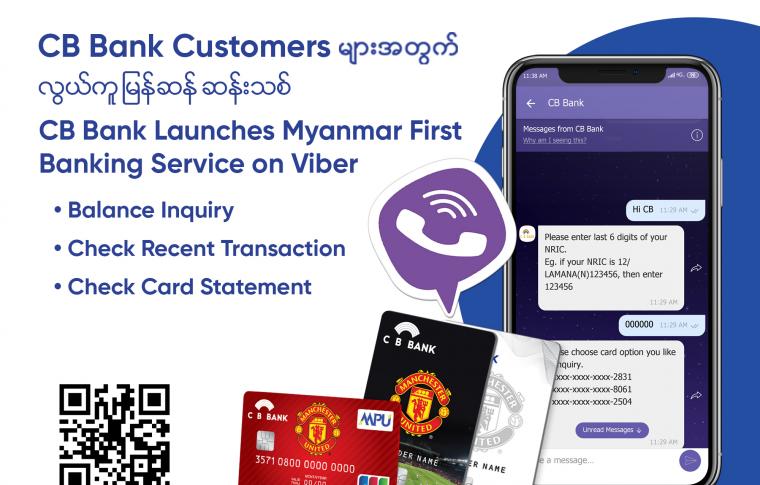

CB Bank launches Myanmar first banking service on Viber

Brought to you by CB Bank, Infobip and Viber

(Yangon, 1 Sep, 2020) – As a leading digital bank, CB Bank believes that innovations are key to improving its customers’ experiences. Upholding this belief, CB Bank has partnered up with Infobip,a global cloud communications platform, and Viber, a widely used community platform in Myanmar, to launch Myanmar’s first banking service on the Viber community platform. This service will herald a new era of technology in Myanmar, replacing traditional call center agents with virtual personal assistants.

“On the Viber platform, ‘CB Bank’ provides a new innovative way to access prepaid, credit and debit card information. Compared to traditional methods which are one-sided and time-consuming, CB Bank uses API technology to provide an interactive, accessible two-way communication channel that supplies customers with real-time information about their prepaid, credit and debit cards 24/7. We have also implemented necessary security checks and measures to protect our customers' information.We will continue to work closely with innovative communication platform providers to find synergies and innovations to reimagine customer service using technology,” said U Thein Zaw Tun, CB Bank’s Managing Director (Business).

To use this service, CB Bank prepaid, credit and debit card holders can initiate a conversation on Viber with a Bot named “CB Bank” by texting “Hi CB” and by providing the last 6 digits of their NRIC. After the customer authenticates his or her NRC and phone number (or Passport Number for foreigners), three services will be available: (1) Balance Inquiry, (2) Recent Transactions, and (3) Card Statement. Upon requesting a service, the Bot will give answers and hold a conversation with the customer.

Furthermore, CB Bank has implemented several security measures and encryption to ensure that customer data is safe and secure. For instance, the mobile phone number registered in the customer’s CB Bank account must be the same as the number registered in the customer’s Viber account. Additionally, ‘CB Bank’ has been verified with blue mark on Viber to protect against frauds. These security measures, in addition to others, will ensure that the financial information of CB Bank’s customers is safely encrypted.

“We are very proud to be a part of this project as CB Bank’s trusted partner in bringing seamless and secure banking communication experiences to the people. We have worked closely with them from the planning stage up to the launch, and we saw the dedication they’ve put into this. Together, we have integrated Viber Business Messaging to enable customers to reach out to CB Bank whenever they need to, wherever they are. As a result, customers can now autonomously inquire about their bank cards without having to go to the bank themselves. Coming from a company that is committed to helping build connected customer experiences, we deeply admire CB Bank’s feat of providing an accessible online channel for their customers,” said Fiona Thu, Infobip-Myanmar’s Country Manager.

“We are delighted to launch ‘CB Bank’ on Viber to bring more convenience to our customers. Now, they can access their card information from anywhere and at any time they wish. In the following months, we will strive to improve user experience and to create a streamlined user journey. We will also be introducing more exciting services such as Mobile Tap & Pay, Virtual Card, and an AI Viber and Messenger Bot powered by machine learning. We would like to thank our customers for their consistent support, and we pledge to bring new innovations and exciting initiatives for our customers in the future.” said U Zayar Aung, Head of Cards and Merchant Services at CB Bank.

********************************************************************

About CB Bank

CB Bank is one of the largest leading private banks in Myanmar established in 1992. With technology at the core of our key initiatives to reimagine the future of financial services, CB Bank has:

- Established technology infrastructure and core banking systems

- Introduced banking products and services for customers and clients on our digital platforms

- Forged strategic partnerships with many partners and service providers

Over 28 years, CB Bank has grown from 33 employees to around 9,000 employees and opened around 245 branches. Tailored to customer requirements, CB Bank offers financial solutions to corporate clients, SMEs and individual customers.

About Infobip

Infobip is a global cloud communications platform that enables businesses to build connected customer experiences across all stages of the customer journey at scale, with easy and contextualized interactions over customers’ preferred channels.

Accessed through a single platform, Infobip’s omnichannel engagement, identity, user authentication security and contact center solutions help clients and partners overcome the complexity of consumer communications, grow their business and increase loyalty– all in a fast, secure and reliable way.With over a decade of industry experience, Infobip has expanded to include 70+ offices on six continents offering natively built technology with the capacity to reach over seven billion mobile devices and 'things' in 190+ countries connected to over 800 telecom networks.The company serves and partners with leading mobile operators, messaging apps, banks, social networks, tech companies, and aggregators.

Media Contact

Corporate Communications

- Ends -